EN SEPA

Preamble

Since February 2013 SEPA (Single Euro Payment Area, not Standard European Payment Agreement) is applied EU-wide in Autopoll instead of the old direct debit procedure (Germany: dtaus, Austria: edifact).

Pre-conditions

- SEPA till version 2.7 is available from Autopoll Version 4.

- SEPA 3.0 is available from Autopoll Version 4.5.3.430 FR04.

- For invoicing and therefore for SEPA too, Autopoll is required in variant PLUS.

Preparations

Step 1 - SEPA-debtee-ID/creditor-ID

To take part in the SEPA direct debit, companies need a debtee identification number (Gläubiger-Identifikationsnummer). In Germany this ID will be issued by the German Central Bank (Bundesbank) in harmonisation with the German Credit Economy (Deutsche Kreditwirtschaft DK). In Austria a so called creditor ID is needed, which is being issued by the National Bank (Nationalbank). The debtee ID or creditor ID has to be applied for at the principal bank.

Step 2 - principal bank

It is absolutely necessary to talk to and with the principal bank to clarify the details for SEPA. Such details are: which exact SEPA version is being used, how many SEPA-files shall be created during an invoicing in Autopoll, how shall these SEPA files be imported at the principal bank etc. Additionally a cash collection agreement of the principal bank is needed to collect the money from the account of the account owner.

Step 3 - principal bank- and SEPA-data

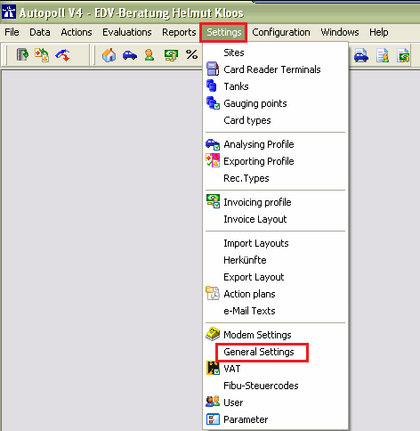

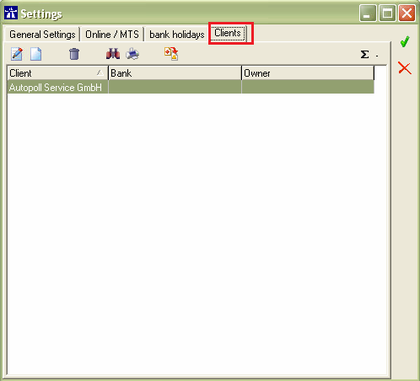

When all SEPA relevant details are clarified with the principal bank, these SEPA basic data have to be registered in Autopoll. Enter these data under Settings-Genreal Settings.

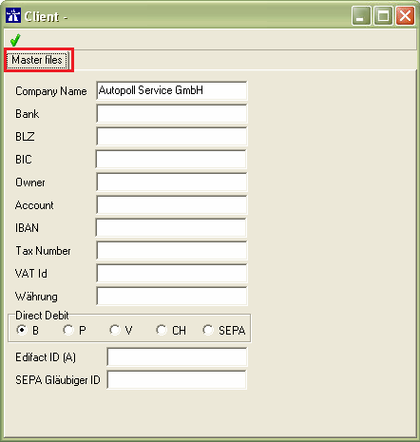

Here all the relevant data have to be entered: the BIC, the name, the IBAN, the tax number, the VAT-ID number, the SEPA debtee ID and in any case the selection of SEPA has to be done.

Step 4 - customers bank- and SEPA-data

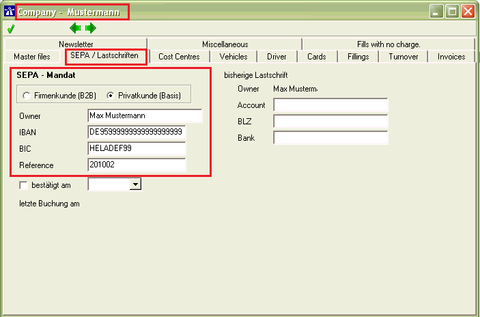

Open the companies over Data-Companies and enter the bank details of the customers in the register "SEPA/Lastschrift".

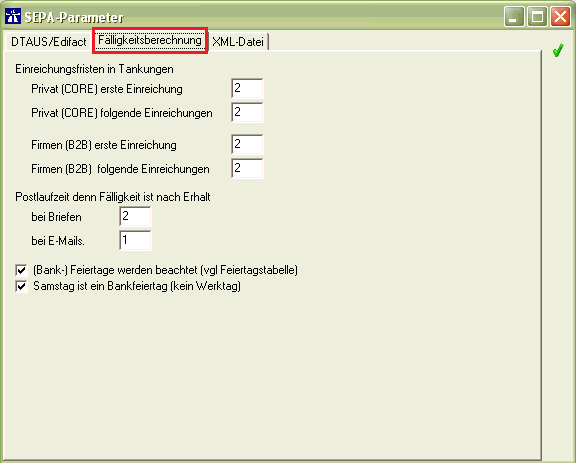

Firmenkunden (B2B) Business clients normally cannot reverse bookings. Debits have to be at the pay office one day before the due date.

Privatkunden (Basis Lastschrift) Private clients can enter an objection within eight weeks after debiting the account, so that the debited amount is being credited back. If a SEPA basic debit is executed for the first time, the debit has to be at the pay office five days before the due date. This is also valid for one time debits. Following debits have to be at the pay office two days before the due date.

As SEPA is undergoing a continuous developing process the exact and actual details have to be enquired at the principal bank like recommended in step 2. Especially the regulations for the time limits change very often.

Conversion old account details to IBAN

For the change from the old direct debit procedure and an old Autopoll version to SEPA and Autopoll version V4 there is the possibility to convert the old customers bank data (account number and BLZ) to the new bank data (IBAN and BIC). Details under conversion to IBAN This function was only being used in the starting time of SEPA, not today anymore.

Step 5 - customers SEPA-mandates

It is necessary to request a SEPA debit mandate from every customer (who wants to pay by direct debit) to create and to transfer the SEPA-file with all the invoices to the principal bank. Only when the mandate confirmation is undersigned and registered or confirmed in Autopoll can the invoices be transfered during the invoicing into the SEPA-file. If a SEPA mandate is not cofirmed, then the invoice will be created but not transfered into the SEPA-file. Additonally a special report is being created during the invoicing and displayed in the print manager of the invoicing which lists all the customers with invoice number whom SEPA mandate is not confirmed. So while checking the invoicing this could be a reason to reset the invoicing and take first care of the SEPA mandate confirmations to invoice afterwards completely. again.

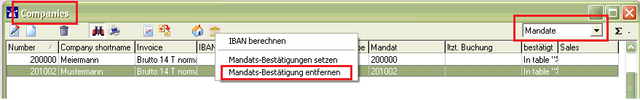

SEPA mandate display

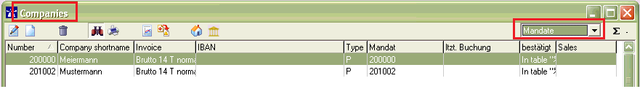

The SEPA mandate situation can be checked under Data-Companies with the dsiplay option "Mandate".

SEPA mandate enquiry

With the Autopoll function newsletter/circular letter it is possible to create the SEPA mandates for the corresponding customers. It is also possible to send the newsletter/circular letter by mail out of Autopoll. Details under newsletter.

SEPA mandate confirmation

After the receipt of the mandate confirmations, these confirmations have to be registered in Autopoll.

I. single confirmation

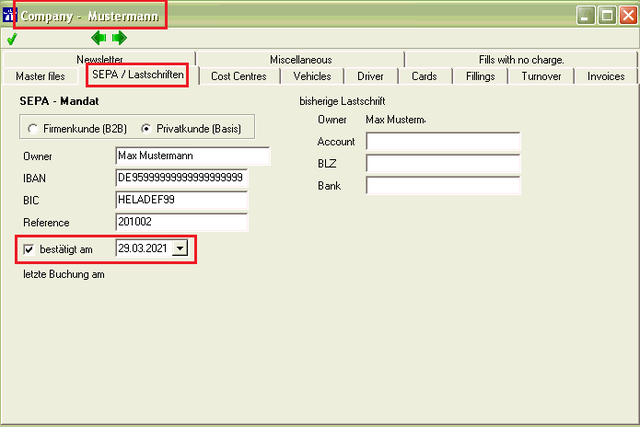

Open the corresponding company under Data-Companies and change to the register "SEPA/Lastschriften".

Activate the checkbox "bestätigt am" and set a confirmation date.

II. mass confirmation

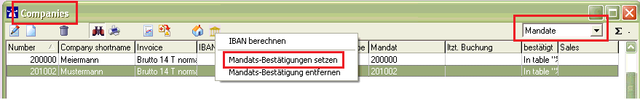

Under Data-Companies (at best with the display option "Mandate") mark all the companies of whom the SEPA mandate shall be confirmed. Open the sub menue for the activation and deactivation of the SEPA mandates by clicking the icon After the selection of "Mandats-Bestätigungen setzen" all the SEPA mandate (checkboxes) of the marked companies will be activated and the date is being set.

SEPA mandate deletion

From time to time SEPA mandates have to be deleted because the customer is not active anymore or wants to change his payment.

I. single deletion

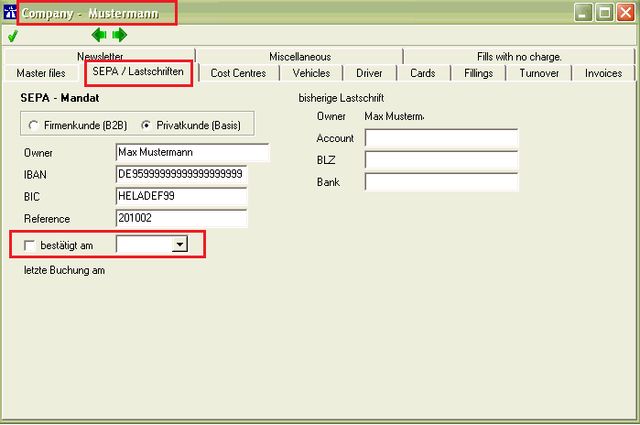

Open the corresponding company under Data-Companies and change to the register "SEPA/Lastschriften".

Deactivate the checkbox "bestätigt am" and erase the date.

II. mass deletion

Under Data-Companies (at best with the display option "Mandate") mark all the companies of whom the SEPA mandate shall be deleted/erased. Open the sub menue for the activation and deactivation of the SEPA mandates by clicking the icon After the selection of "Mandats-Bestätigung entfernen" all the SEPA mandate (checkboxes) of the marked companies will be deactivated and the date is being deleted/erased.

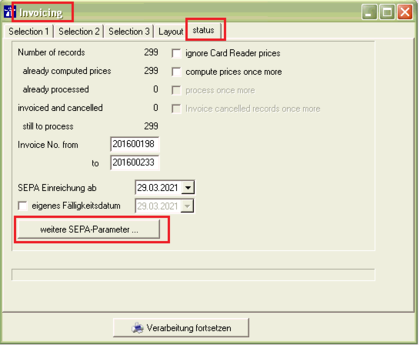

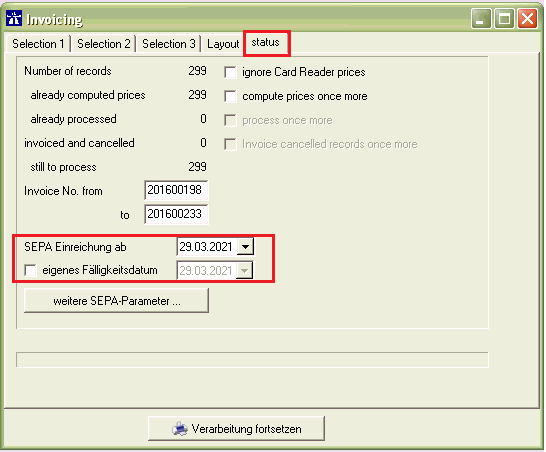

SEPA parameters invoicing

During the first invoicing with SEPA it is necessary to configure one time the following SEPA parameters which have to be clarified in advance with the principal bank. After the calculation of how many transactions shall be invoiced during the invoicing (Details under invoicing) the button "Weitere SEPA-Parameter" is available in the register "status".

Due date calculation

Configuration of all the parameters for the calculation of the due date and filling date.

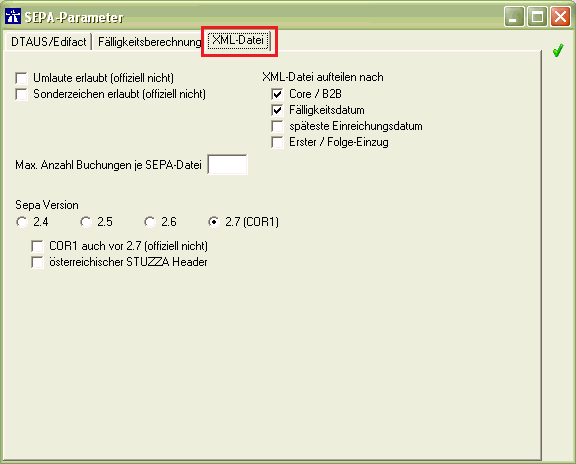

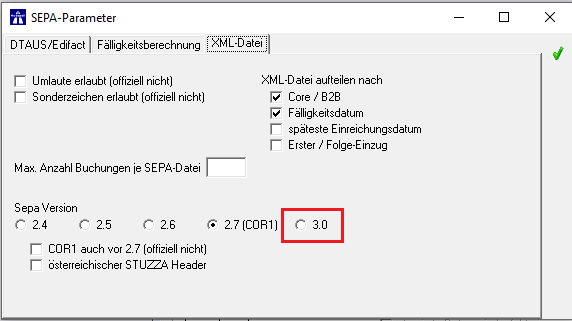

XML-file

from V4

Configuration of the SEPA version and the form/shape of the SEPA files which have to be created.

from V4.5

Configuration of the SEPA version and the form/shape of the SEPA files which have to be created.

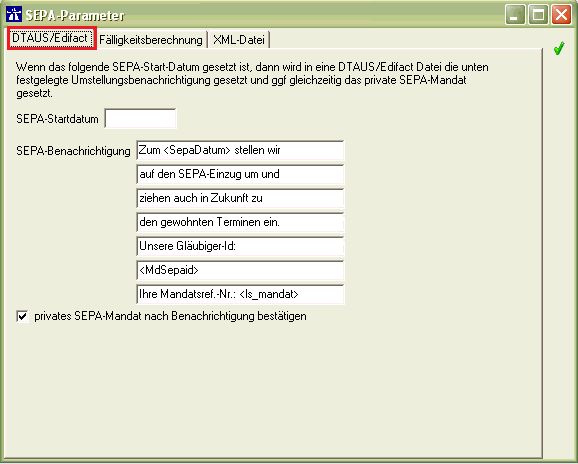

DTAUS/Edifact

This is not needed anymore and is not applicable in the future.

This area was being used in the starting time of SEPA to remember the customers in the reason for payment of the direct debit file (dtaus/edifact) that SEPA has to be used and to set a mandate (only for privat customers).

Own due date

If it is agreed with the principal bank that the due date and filling date shall not be calculated automatically, then it is possible at this position to enter an own due date and filling date which ignores the above mentioned due date calculation.

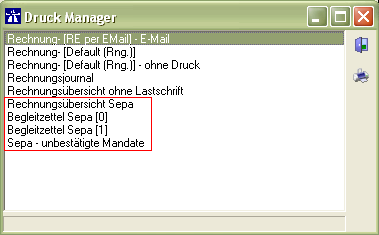

Additional reports in the print manager of an invoicing with SEPA

Besides the invoices, the invoicing journal and the "invoicing overview without direct debit", a separate report "invoicing overview SEPA" will be created. In addition for each SEPA file created during the invoicing one accompanying ticket will created too. If there are uncofirmed SEPA mandates then a separate report "Sepa - unbestätigte Mandate" appears in the print manager.

Hint

Autopoll only offers the tools to invoice transactions with SEPA direct debit. But how these tools are being used have to be checked, decided and configured by the customer in corporation with his principal bank.